Learn how to calculate PAYE on salary for your good.

The knowledge will help you understand your actual salary.

New feature:Check out news exactlyfor YOU find Recommended for you block and enjoy!

Photo: canva.com (modified by author)Source: UGC

SARS (South African Revenue Service) requires employers to collect taxes from employees on its behalf.

It is overwhelming for businesses to simultaneously manage their employees while teaching them how to calculate PAYE on salary.

There are several ways for calculating PAYE in SouthAfrica.

Read also

It is the most straightforward, especially when dealing with variable income.

Read also

Springbok salary: How much do the players earn in 2025?

How do you calculate PAYE?

Read also

SARS uses one’s annual income to determine their PAYE tax liability.

Therefore, when computing for PAYE, consider the rebates, deductions, and tax thresholds provided by SARS.

Here are vital things to note and steps to follow when computing your PAYE:

1.

Read also

Calculate your annual gross income.

Computing the annual gross income for fixed and variable salaries differs

I.)

Fixed salary

Getting your annual gross income is straightforward if you earn a fixed salary.

Read also

Use this formula to calculate it:

Employee’s gross annual salary = monthly salary * 12

II.)

Variable salary

It is more involving to compute PAYE for employees who receive variable incomes.

Factor in regular deductions such as provident funds.

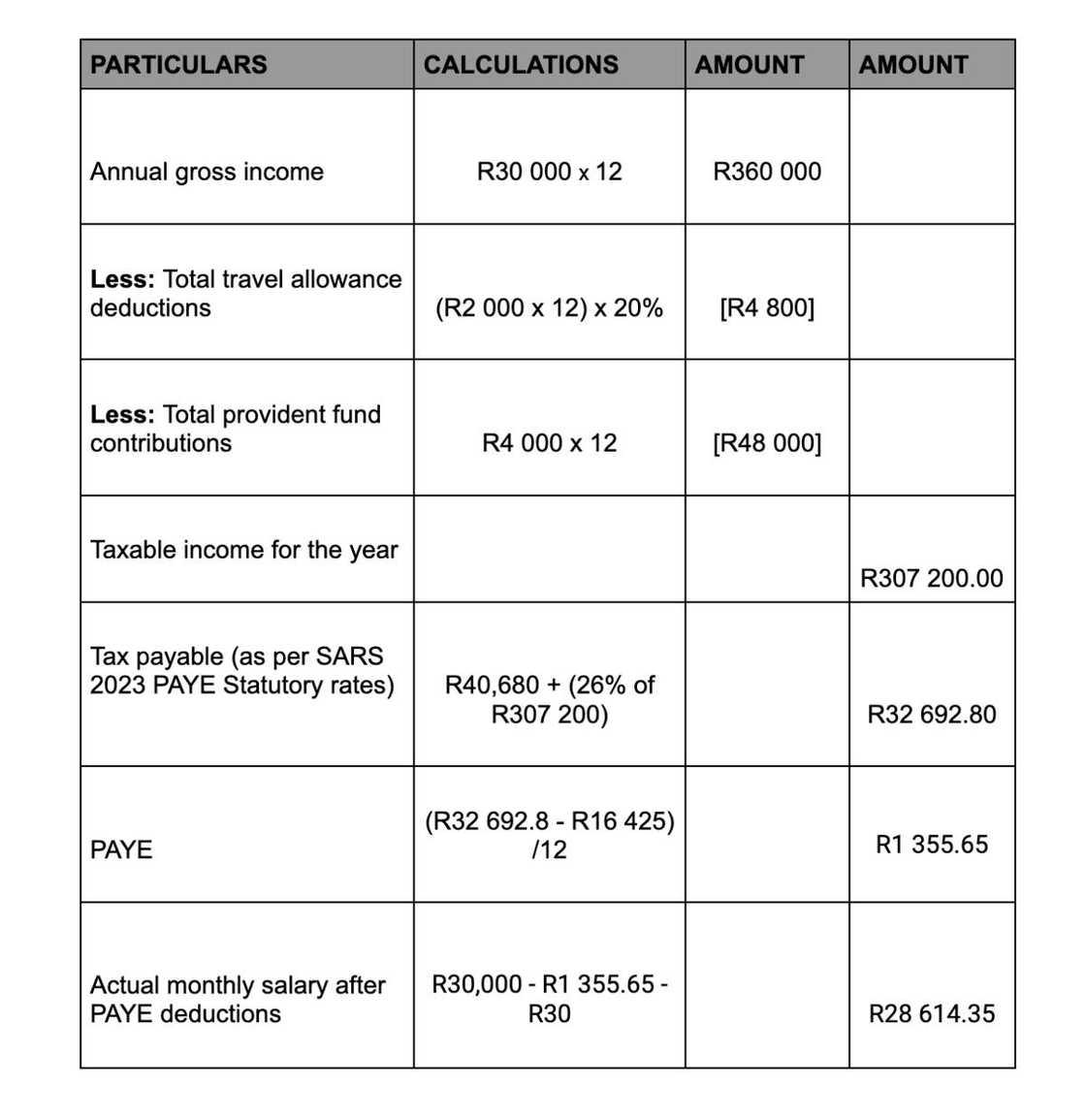

An example of PAYE calculations for someone who works in South Africa. Photo: Created by authorSource: UGC

SARS limits a person’s deductions to about 27.5% of the employee’s gross remuneration.

Moreover, the uppercut is set at R350000 for tremendous income employees.

Deductions = (Sum of monthly RAF, pension, etc.

Read also

)*12

3.

You should also note that monthly travel allowances are a special case.

The employer has to determine how the employee spends their travel allowances.

A SARS PAYE statutory rates table. Photo: @www.sars.gov.za (modified by author)Source: UGC

If one spends 20% of the allowance onbusinesstrips, 80%will be subjectto PAYE deductions.

Complete guide on the latest tax brackets South Africa

I.)

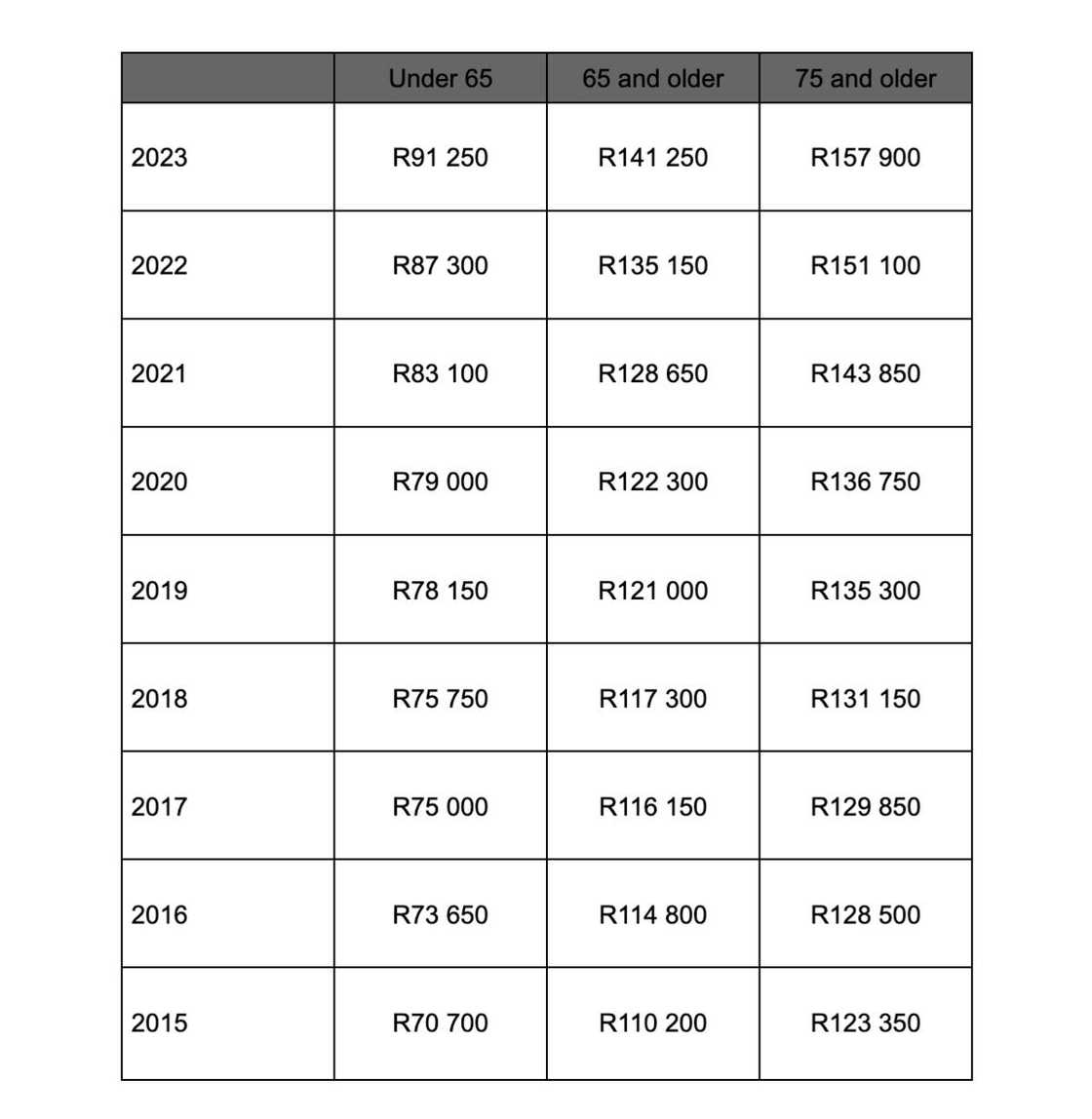

Take into consideration SARS rebates, deductions, and tax thresholds.

Read also

Ideally, if the taxable income falls below the thresholds, the employee will incur no deductions.

Check out the 2023’s Tax thresholds table below.

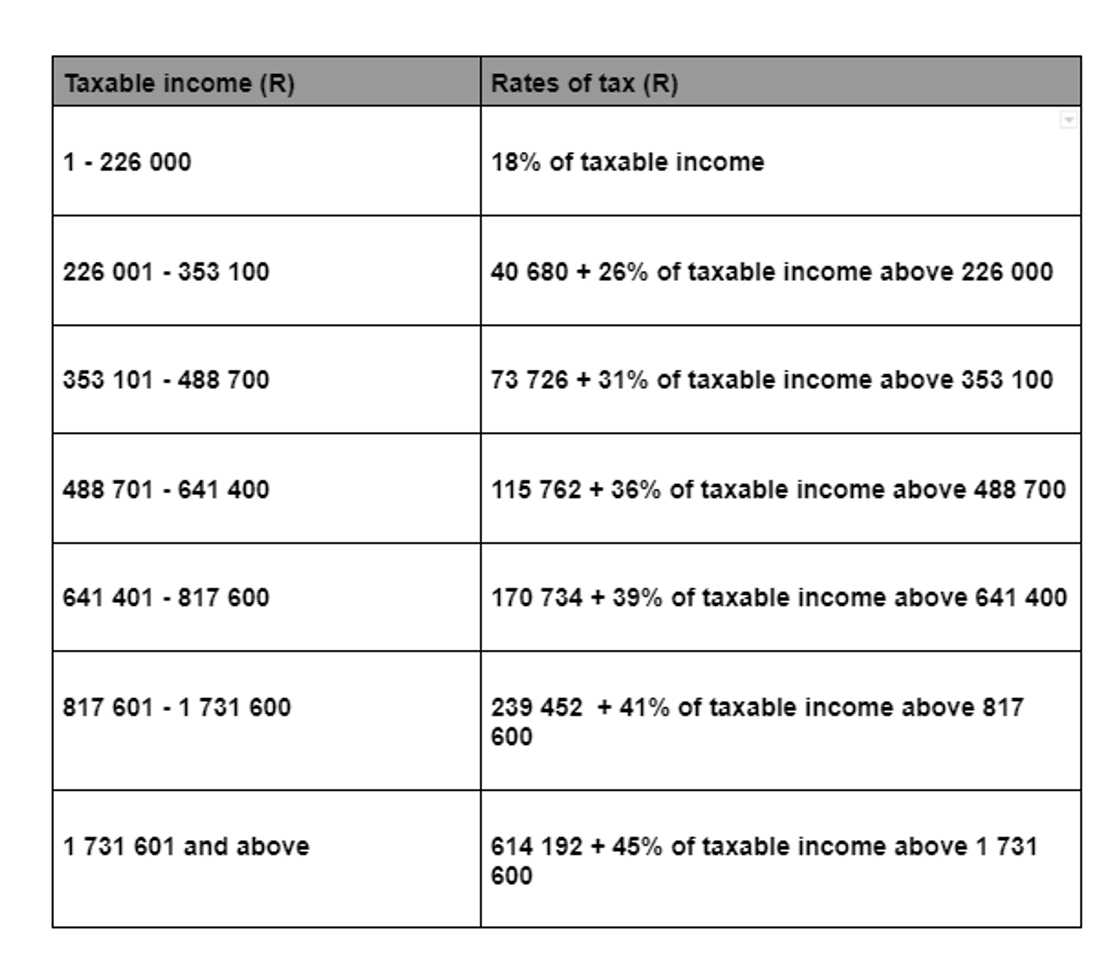

Consider PAYE statutory rates before calculating the employees due PAYE.

A SARS tax thresholds table. Photo: @www.sars.gov.za (modified by author)Source: UGC

Start by identifyingthe tax bracketwhere your employee falls before working out the payable tax.

Check out the current SARS' PAYE statutory rates table is below.

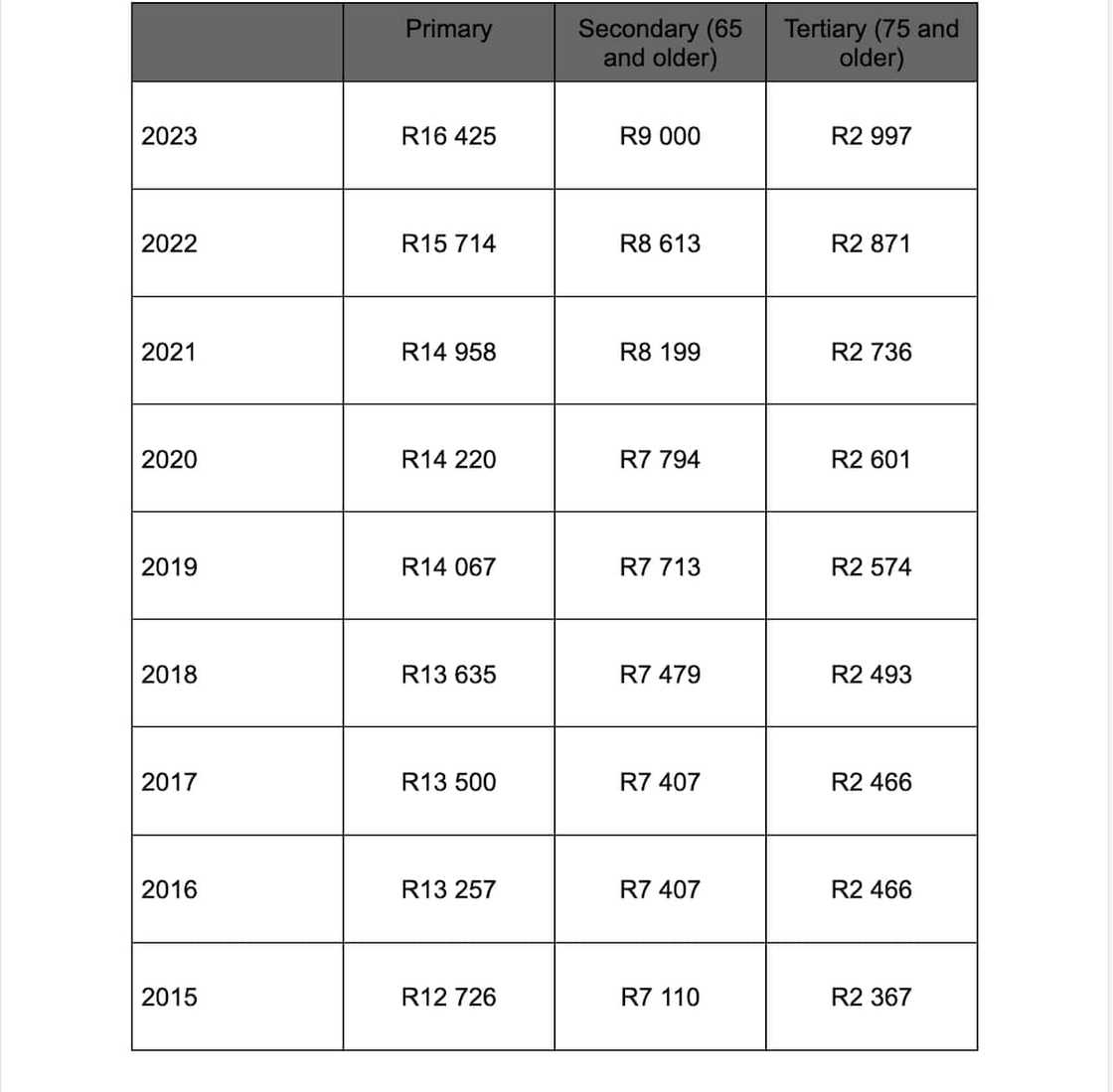

Deduct rebates from the tax payable.

A SARS tax rebate table. Photo: @www.sars.gov.za (modified by author)Source: UGC

The current rebates rates table is below.

She also travels 80% of the total time you are working.

SARS released a tax table for 1st March 2022 to 28th February 2023.

Read also

The newrates of taxfor individuals are as follows:

What is the tax threshold in South Africa?

Employers determine the age of the employer before calculating the PAYE.

One’s age determines the age bracket of the threshold and rebates the employer should use in the calculations.

Read also

The income tax threshold is the income level at which a person begins paying income taxes.

The income tax rebate is an incentive that reduces the amount of tax that a person has to pay.

SARS requires the employer to fill the EMP201 (Monthly Employer Declaration form) after making PAYE payments.

Read also

These are PAYE’s payment alternatives.

Note that SARS does not accept manual payments, and cheques are returned to the client.

For further help with PAYE calculations, contact SARS today.

Read also

Do foreigners pay PAYE in South Africa?

Non-residents are taxed on their South African-based sources of income.

It is called a residence-based tax system.

Read also

Who must pay tax in South Africa?

Youare liable topay income tax if you earn more than:

I.)

The 2023 year of assessment (1st March 2022 28th February 2023)

II.)

Read also

Step-by-step guide for 2024

III.)

How does a minor pay income tax?

How do you work out PAYE on salary?

If you are no good at manual calculations, use the automatic SARSIncome Tax Calculatorfor 2023.

The Pay as You Earn calculator has a simplified process.

Key in your income, age bracket, and other details for it to do the calculations.

What is medical aid tax credit?

Find it out here

How much tax do I pay on my salary in South Africa?

Income tax is a broad topic.

Is PAYE calculated on gross or net salary?

like note that:

Learning how to calculate PAYE on salary is the best way to monitor your finances.

Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

A certificate of compliance is a legal statement that verifies that specific criteria have been met.

It is a formal declaration that an individual or corporation has adhered to a set of requirements.

Source: Briefly News

Jedidah TabaliaJedi is a journalist with over 5 years working experience in the media industry.

She has a BSc.

She loves traveling and checking out new restaurants.

Her email address is jedidahtabalia@gmail.com